Middle Tennessee is off to a great start this year when it comes to home sales; up 5% over last year according to Greater Nashville Realtors. So what does this mean for your multifamily property? As you are aware, there are a number of factors that influence market rent prices for your property. Some of these factors are within your control, while others are external forces over which you have no control. In this article, we will look at a few factors that influence rental prices and what you can do to maximize your rents in the current economic environment.

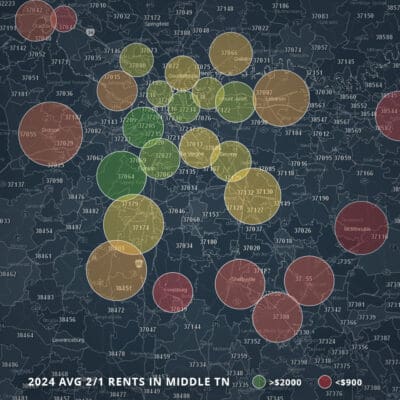

The Location of your property will have a huge impact on what you can charge for rent. This graphic illustrates rental prices based upon zip codes.

Location, Condition, and Amenities

The market rent is determined by the physical characteristics of a property, which include location, condition, and amenities. You have some control over these factors either at the time of purchase or through maintenance and capital expenditures. Although very important, these factors are not our focus in this article. It’s well-known that over time, wear and tear on a property will inevitably put downward pressure on rents as newer, nicer buildings are constructed in your area. A-class properties become B-class properties and eventually C or even D-class properties, but this is a slow process that takes decades to actually impact your rental rates.

We always suggest finding good contractors to help you turn units that become vacant. Doing a little bit of work each time your unit is empty goes a long way in preserving your property’s value. Deferred maintenance is an easy way to lose tenants and decrease your leverage at the bargaining table when it comes time to sell.

Deferred maintenance also negatively impacts tenant retention, and nothing will drive your rental rates down faster than a bunch of vacant units. Dave Childers (Cedar Rock Capital) says: “I suggest finding creative ways to keep your units filled while at the same time investing money into your apartments. For example, when the end of a lease is approaching, I talk to my tenants about some potential upgrades that I’d like to do while at the same time increasing their monthly rent. I offered tenants upgraded window blinds when they renewed their leases for another year.” This win-win situation often softens the news of a rent increase while simultaneously investing into your property and retaining a tenant. Investors know that new tenants are far more costly to acquire than window blinds. You could utilize this strategy with anything that adds value to your property but also improves your tenants’ lives. Check out this blog article for more examples

Economic Factors That Influence Rent

When it comes to rental prices, there are some things that are just out of your control. Although there are literally dozens of these economic factors, here are a few of the ones that will have the most impact.

Inflation Is Pushing Rental Prices Up

Owning a rental is just like owning a business. The cost of maintaining your property is wrapped up in labor and material costs as you have to put money into the property or risk losing tenants or rental income. So as inflation increases the cost of running your business, you must also increase your rents. As inflation slows, your rent increases should also slow down, or you run the risk of losing your tenants to the competition.

Jobs and Market Growth

Jobs and Market Growth

A sudden spike in the job market, which happens naturally with economic growth, can create a demand for housing, especially short-term housing like rentals. The inverse is also true. An economy that is shrinking means there will be less demand for your units as people may be relocating to find work. This external demand happens outside of your control, with city governments and state and even national economic policies having a bigger impact on job and market growth. For this reason, we always recommend that investors look at the economic policies of the local and state governments before choosing to invest. For example, we have a listing for duplexes in Manchester, TN. One of the biggest reasons these properties are demanding top dollar has to do with the i-24 Industrial Park being built a couple of miles away from these duplexes. This industrial park has the potential to bring in thousands of new jobs in a short period of time, and the demand for housing will increase even while the park is being built.

As seen, the variation in rental prices can be significant, even within the same region. These figures exemplify how local economic growth, such as the development of the i-24 Industrial Park near Manchester, and housing supply dynamics are influencing market rents. It’s evident that areas poised for economic development are commanding higher rents. Investors would do well to study such data when considering where to acquire rental properties, as these numbers reflect both the current market and potential future trends. This graphic serves as a clear indicator of why understanding the local economy and housing supply is critical for maximizing your rental revenue.

Housing Market Pushes Rental Prices Around

Interest rates often are one of the biggest factors for when renters decide to become homeowners. High interest rates will keep renters renting a little longer as they may be willing to wait for the rates to drop so they can afford the house they really want. In addition, a hot real estate market with homes selling at asking price or above means potential home buyers will have to wait longer to get into a home. The impacts of high interest rates or demand for housing do have an impact on rental prices, however, they tend to lag considerably behind interest rate changes.

Supply of Housing

Finally, the supply of housing will have a large impact on rental rates. When there is an abundance of rentals that are vacant, prices will have to come down. We see this currently in the Nashville area as more than thirty-thousand units are coming online in the next two years. Property managers are desperate to get tenants and, as a result, are offering massive discounts or even months for free. This same thing can happen in secondary or tertiary markets as developers look further and further out to build their next apartment complexes, especially as people are willing to commute to save money.

Supply of single-family homes also impacts rents. Although not often the case, an oversupply of houses will inevitably lead to price drops, which means more renters will become homeowners. This exodus will eventually have an impact on your rental demands.

Conclusion

As you can see, there are many factors contributing to market rental rates. In this article, we only focused on a few. There are those that you can control, such as amenities and the condition of your property, but there are many more factors that are out of your control, like the job market, housing supply, and interest rates. Your strategy in multifamily will need to determine which of these factors you will pay the closest attention to. If you are a fix and flip investor, you will need to find places that have an abundance of supply in order to find margins that work for you. If you are a buy and hold investor, you’ll want to find markets that are poised for economic growth. If you are a builder/developer, finding markets where the supply is down may be your best ticket to maximizing your earning potential. Feel free to give us a call today to discuss your investment strategy and some of the properties that may work well for you.