50•Percent•Rule

FIFTY/ % / Percent / ‘Rule

A guideline used in evaluating multifamily real estate which states that 50% of the rental income will be allocated to expenses, with the remaining 50% considered as profit.

When it comes to evaluating expenses in real estate investment, a common piece of advice is to apply the 50% rule. While this rule might be useful as a quick evaluation of profitability, the constant changes in the multifamily market leads to inaccurate projections. Here are four key reasons why a detailed approach to expense evaluation is vital in the current real estate market.”

1. Location Matters:

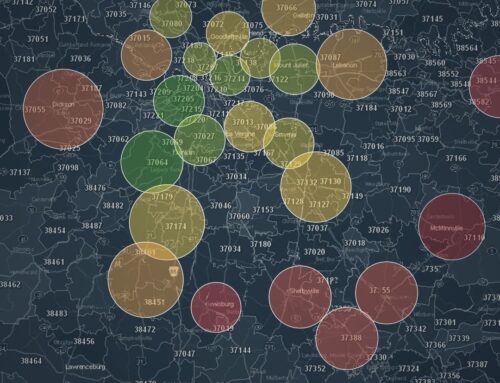

One of the fundamental factors influencing expenses in real estate is location. Property taxes, for example, vary significantly from county to county, impacting the overall expense structure. Additionally, insurance premiums, utility costs, and even maintenance expenses can differ based on the geographical area. It’s essential to factor in these location-specific variables when evaluating expenses.

2. Property Class and Maintenance:

Not all properties are created equal. Class B or Class C properties may require more frequent maintenance and repairs compared to Class A properties. Neglecting this aspect can result in underestimating expenses, leading to financial strain down the line. Properly assessing the condition and maintenance requirements of the property is vital for accurate expense evaluation. I always tell my clients to utilize unit turns to do as much maintenance as you can (Read more about that here), that way you are not left footing an even large bill later on down the road.

3. Size and Scale:

The size of the property plays a significant role in determining operational costs. Larger properties with 50 or more units may require on-site property management and maintenance staff, increasing payroll expenses. Conversely, smaller properties with fewer units might not necessitate on-site personnel, but outsourcing maintenance services could incur additional costs. Understanding the scale of operations is crucial for estimating expenses accurately. If you are self managing we’ve found the sweet spot for most investors to be around 15 to 20 units. If you go beyond that it becomes harder to stay on top of all the work required and you will typically have to start outsourcing more of the operation.

Expenses due to amenities, lawn care and landscaping vary widely based upon they class of property.

4. Utilities and Amenities:

Utilities such as water and electricity can significantly impact expenses. Properties where utilities are individually metered might result in lower expenses compared to properties with shared meters. Additionally, amenities like lawn care, landscaping, and communal facilities can add to operational costs. Evaluating these factors individually is essential for a comprehensive expense analysis. Fortunately service industries tend to be “sticky” when it comes to inflation. So although the pool supplies may cost you more from the store the cost of servicing your pool will remain somewhat stable over the next couple of years.

Conclusion: Rethinking Expense Ratios.

While the 50% rule may offer a quick evaluation method, it often oversimplifies the intricacies of expense management in real estate. Instead, consider using a more suitable baseline, such as a 30% expense ratio, for initial assessments. However, always delve deeper into property-specific factors to arrive at a more accurate expense projection.

Proper evaluation of expenses in real estate requires a nuanced approach that takes into account location, property class, size, utilities, and amenities. While rules of thumb like the 50% rule can serve as starting points, they should not be relied upon blindly. By understanding the unique characteristics of each property and conducting thorough due diligence, investors can make informed decisions and achieve long-term success in real estate investment.